Overtime wages must be paid no later than the payday for the next regular payroll period after which the overtime wages were earned. To properly compute overtime on a flat sum bonus, the bonus must be divided by the maximum legal regular hours worked in the bonus-earning period, not by the total hours worked in the bonus-earning period. This calculation will produce the regular rate of pay on the flat sum bonus earnings.

Overtime on a flat sum bonus must then be paid at 1.5 times or 2 times this regular rate calculation for any overtime hour worked in the bonus-earning period. Overtime on production bonuses, bonuses designed as an incentive for increased production for each hour worked are computed differently from flat sum bonuses. To compute overtime on a production bonus, the production bonus is divided by the total hours worked in the bonus earning period. This calculation will produce the regular rate of pay on the production bonus.

Overtime on the production bonus is then paid at .5 times or 1 times the regular rate for all overtime hours worked in the bonus-earning period. Overtime on either type of bonus may be due on either a daily or weekly basis and must be paid in the pay period following the end of the bonus-earning period. All the information you need is usually on employee timesheets or time cards. These include the employee's pay rate, overtime rate, and information from the time clock.

This is all you need to work out the total hours worked and even the amount to send through to payroll. For businesses with hourly employees, tracking employee time helps you calculate payroll correctly. Tools like time clock software can track employee time down to the minute. Tracking time this way ensures that your employees get paid for the work they did and that you're paying out the correct amount for each pay period.

This free time card calculator fulfills the needs of managers and hourly employees. Afteremployees track timefor the week, insert their hours worked to calculate their expected pay. Include their overtime and breaks to ensure their hours and wages meetFair Labor Standards Act regulations. For this to be helpful, you'll need to decide what your pay period is.

Hours Worked Calculator 2 Weeks Or you can determine your hourly rate for a shorter period of time, such as a month or a few weeks. An employee is contracted to work 29 hours a week across four working days. The date they are paid is the last day of their pay period. The employer looks to make a flexible furlough claim for the period 1 May 2021 to 14 May which is a whole pay period. The employer calculates the usual hours for this period. Employees can accurately track time via the software on various devices.

Then the information from the timesheets is automatically synced into the payroll system. You can automate the payments process by inputting the wage rates and setting the pay periods, which can be weekly, bi-weekly, monthly, or twice a month. There are several ways and many programs available to help employers learn how to calculate employee hours worked or keep freelancers on track with how to add up work hours. But the most common way to clock hours for payroll is using your start and end time. From there, you can figure out how to calculate hours worked per day and then add them up to your total hours for your upcoming pay cycle. Example of a first claim - The image shows an employer who furloughs two employees at the start of the pay period and adds a third a short time later.

The start date of the claim period is when the first employee was put on furlough. The employer should include all employees who were furloughed during this claim period, even if they were put on furlough at different times within the period or are paid at different times in the pay period. The claim is then made 6 days before the end of the pay period, to make sure the grant is available to be paid out on time.

Yes, there are certain types of payments that are excluded from the regular rate of pay. If you're self-employed and need to calculate your hourly rate, you'll need to decide the length of your pay period. For example, take a stretch of time where you were working, like a month or a week, and consider that your pay period. As you work during that length of time, hold on to all of the paychecks you earn.

To get your hourly rate, divide the income you made in that period by how many hours you worked in that time. If you're salaried, figure out roughly how many hours you work in a year, then divide your yearly salary by that number. An employee has a calendar month pay period and usually works 40 hours per week. The employee was paid £2,000 in the last full monthly pay period before 19 March 2020.

The employee is flexibly furloughed from 1 May 2021, working 10 hours per week. The flexible furlough agreement ends on 12 May 2021 and the employee returns to work their full usual hours from 13 May 2021. This article reviewed a lot of options for tracking employee time.

Department of Labor does not enforce how employers track employee hours, it does provide guidelines to track employee hours accurately. Regulations that state how long an employer must retrain payroll related data. Currently, employers are required to retain timecards and payroll related calculations for at least two years during and after employment. A complete list of wage-related information is located on the Department of Labor website dol.gov. If you would like the overtime calculator to calculate the gross overtime wages for a number of overtime hours worked, enter the number of hours on this line.

Otherwise, if you are only interested in the overtime rate of pay, leave the field blank. Time spent training whilst furloughed is treated as working time for the purposes of the minimum wage calculations and must be paid at the appropriate minimum wage rate. Employers must make sure that the wages and furlough payment provide enough monies to cover all working time including these training hours. Example of a second claim – The image shows an employer who makes another claim after the first one has ended. Two employees have been furloughed continuously since the first claim, and the claim periods follow on with no gaps in between the dates – though one returns to work before the end of the pay period.

One employee worked for two days at the start of the second period but is then furloughed again. The employer should include all employees who were furloughed during this claim period, even if they were put on furlough at different times or are paid at different times in the pay period. The claim is made 6 days before the end of the pay period, to make sure the grant is available to be paid out on time. The agreed upon regular hours must be used if they areless thanthe legal maximum regular hours. For example, if you work 32 to 38 hours each week, there is an agreed average workweek of 35 hours, and thirty-five hours is the figure used to determine the regular rate of pay. As a young startup company, you might not have all the resources or funding in the world to keep payroll straight.

Having your employees keep track of their hours by using a calculator like this is one option, though that can get risky. There's no way to keep employees accountable for being honest on their time cards, so you have to trust they'll put the right hours down. But, if you're looking to cut costs, this isn't a bad place to start. It may just be a good idea to invest in some software to help track your employees' hours as your company scales. R Ltd's employee has been furloughed continuously since 1 May 2021. R Ltd makes a claim for 1 August 2021 to 31 August 2021.

R Ltd has calculated that the minimum furlough pay for this period is £1,450, which is 80% of the employee's usual wages. An employer's employee has been furloughed continuously since 15 January 2021. The employer makes a claim for 19 July 2021 to 25 July 2021. The employer has calculated that the minimum furlough pay for this period is £400, which is 80% of the employee's usual wages.

R Ltd has calculated that the minimum furlough pay for this period is £1,500, which is 80% of the employee's usual wages. U Ltd's employee has been furloughed continuously since 15 April 2020. U Ltd makes a claim for 1 November to 30 November 2020. U Ltd has calculated that the minimum furlough pay for this period is £1,500, which is 80% of the employee's usual wages. For claim periods starting on or after 1 May 2021, the employer should not include the days where the employee was on statutory sick pay related leave, leaving 359 days. The employer should also not include wages related to a period of statutory sick pay related leave – this was £1,250, leaving £21,750.

For claim periods which end on or before 30 April 2021 the employer cannot remove these days or these amounts of wages from the calculation. Plus, this overtime and holiday pay rate calculator will calculate the total gross overtime wages for a given number of OT or holiday hours worked. So if you want to know how much OT or holiday pay you will receive, enter the number of hours and the calculator will instantly calculate it for you.

Let The Hourly Wage Calculator do all the sums for you - after the tax calculations, see the annual pay, and the monthly, weekly or daily take-home. Discover what a difference a few hours overtime will make. These tools often integrate with or allow exports to payroll tools, and you can be sure that your employees get paid on time for the hours they log. And speaking of money, investing in time clock software has financial benefits for you. Enter your current payroll information and deductions, then enter the hours you expect to work, and how much you are paid. You can enter regular, overtime and an additional hourly rate if you work a second job.

This calculator uses the 2019 withholding schedules, rules and rates . Calculate how many hours you work at your job every week. If you work longer hours at certain times of the month, then track your time for a month, and divide your annual pay by 12. Be sure to use the same pay period that you selected to figure up hours. Again, this could be for a single project or several paychecks.You can choose whether or not to include taxes in your calculations.

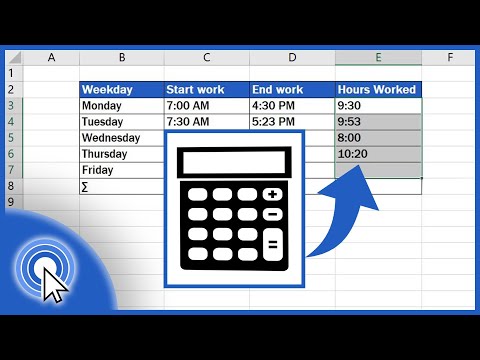

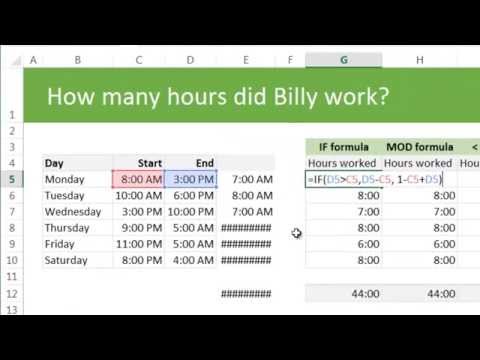

Note that if you don't include taxes, your hourly rate will appear higher. To calculate how many hours you've worked, enter your start and end times for each day of the week. Doing this will show how many total hours you worked that week. Be sure you're inputting the right time of day by checking the AM / PM drop-down menu. It's essential to be honest and to set the correct hours for yourself so that your employer sees you as a trustworthy team member. Employees and employers can keep accurate records of hours on the job.

The DOL-Timesheet App helps track regular work hours, break time, and overtime hours. The new version of the app also enhances the comments capability, offers multiple pay frequency options, and additional pay calculations. Higher hourly rate for working during weekends or holidays is generally a matter of agreement between the employer and the employee. As long as total hours worked don't exceed 40 hours per week, pay rate isn't subject to federal or state laws .

Calculating payroll and hours worked is simple but can be a hassle. You add up all the time an employee worked that week or month, convert time to decimal format, and multiply it by their hourly rate. Here's how you can automate the process and have payroll calculated in less than a minute. The most common way involves recording start time and end time for hours worked. Some employers, require their employees to record their hours on paper, while others use a punch clock system to log hours. Once work hours are recorded, the employer tallies up the totals for payroll.

Some policies and procedures are taken as a standard to handle the calculation of work hours. Then by simple math employers can figure out each employee's paycheck. This is why more and more businesses are turning to payroll solutions. As a payroll company, Wrapbook figures out how to calculate hours, including overtime. We act as an employer of record and administer paychecks, and we keep track of payroll taxes.

Digital timecards allow payroll to get done faster with transparency between the producer and crew member. Our time card calculator automatically tabulates all work hours and converts them to dollars and cents. The calculator is totally electronic, ridding your business of those cumbersome and error-prone paper time card weekly and monthly reports that get bent, torn, or lost. If you would like the calculator to calculate how much you would earn annually in overtime wages if you worked a given number of overtime hours each pay period, select your pay period. The same principles apply where the employee is returning from a period of unpaid statutory family-related leave. Therefore, if a furloughed employee takes holiday, the employer should pay their usual holiday pay in accordance with the Working Time Regulations.

If an employee is flexibly furloughed then any hours taken as holiday during the claim period should be counted as furloughed hours rather than working hours. Employees should not be placed on furlough for a period simply because they are on holiday. This means that employees should only be placed on furlough because your operations have been affected by coronavirus and not just because they are on paid leave. Overtime is calculated based on hours actually worked, and you worked only 40 hours during the workweek.

Another example of where you get paid your regular wages but the time is not counted towards overtime is if you get paid for a holiday but do not work that day. In such a case, the time upon which the holiday pay is based does not count as hours worked for purposes of determining overtime because no work was performed. Divide your total earnings for the workweek, including earnings during overtime hours, by the total hours worked during the workweek, including the overtime hours. For each overtime hour worked you are entitled to an additional one-half the regular rate for hours requiring time and one-half, and to the full rate for hours requiring double time. Federal law doesn't require lunch breaks, but 21 states have their own meal and rest break rules. Typically, the DOL considers breaks under 20 minutes to be paid time.

Meal and rest breaks over 30 minutes are not paid time. If you're not tracking breaks in your employees' time card calculations correctly, you're at risk for a wage and hour lawsuit. Subtract hours from your calculation if you receive paid time off. Add together the number of hours you take off work each year and subtract this number from the total number of hours you worked in the year. Remember to include holidays, sick leave, special leave, and any time when you start late or finish early.Remember only to include paid time off that you will actually use.

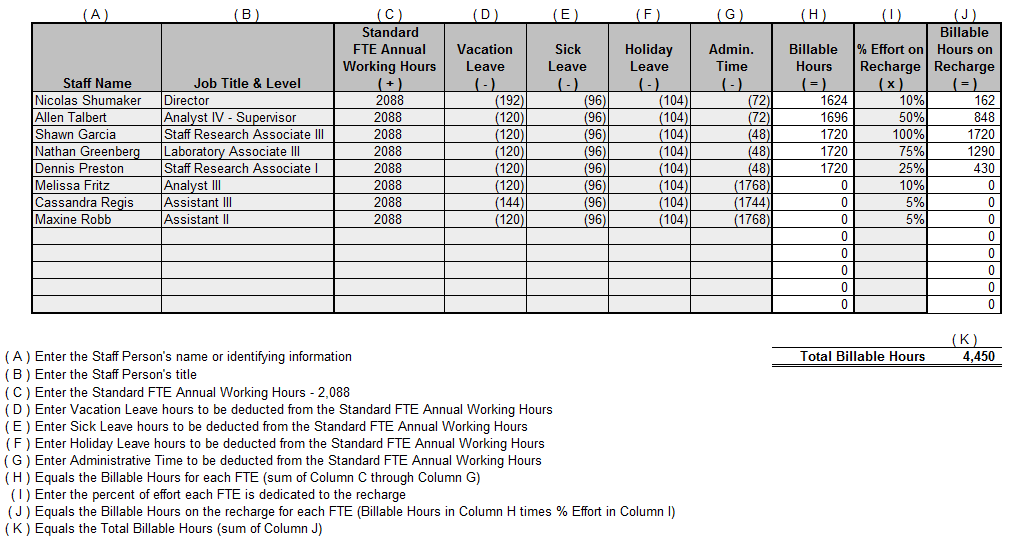

As an example, you may have accrued two weeks of sick time, but you also aren't likely to use all of it. Each of Acme's 28 full-time employees worked an average of 2,000 hours per year after excluding vacation, sick leave, holidays, and other non-work time. This works out to 40 hours per week for 50 weeks of the year. T Ltd's employee has been furloughed continuously since 1 May 2020.

From 1 July 2020, the employee returns to work part-time for T Ltd and is furloughed for the rest of their usual hours. T Ltd makes a flexible furlough claim for 1 July 2020 to 31 July 2020. An employee started work for M Ltd on 1 April 2020 and is paid a regular monthly salary on the last day of each month.

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.